With Leatherback,

Money Moves With You.

Wherever you go, we got you.

200k+ downloads

One App, Every Currency

Built for everyone who wants flexibility with their money

Get paid by anyone, anywhere

Your accounts are global - open to everyone, making it convenient to get paid, wherever you are.

Make local transfers on the go

Whatever you're spending on, we've got you covered with just a few clicks.

Perfume

Debit · Personal276.00 CAD

Groceries

Debit · Food40.45 USD

House Rent

Debit · Successful1,750,000.00 NGN

Family Dinner

Debit67.00 GBP

Make borderless payments with ease

Send money to anyone abroad in your local currency without the hassle of currency conversions - we offer the best rates around.

Vacation 🏝️

Send

Invest

Vacation to Toronto

GBP 5,880.00

CAD 10,545.19

Exchange currencies

Effortless currency swaps, just a tap away

Currency Exchange

Enter amount

NGN

You'll get

GBP

Transaction Fee

NGN 0.00

Exchange Rate

fetching updated rate...

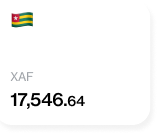

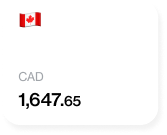

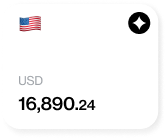

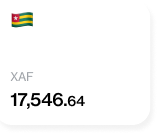

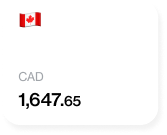

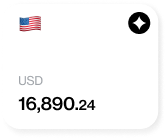

Your Money Moves With Ease

Get account in pounds, dollars, naira, and more, all from one app

Why choose Leatherback?

Safety and Security

Our ISO certification and PCI DSS compliance affirm our commitment to the highest security standards. With 2FA authentication and a dedicated fraud and security team, we safeguard your funds at every step with established financial institutions, providing you with peace of mind and confidence in our services.

Global Partners

Leatherback works hand-in-hand with trusted financial institutions, keeping your money safe, so you can enjoy global connectivity with confidence. We do not lend out your money, so we are not covered by the FSCS.

Global Reach

You are free from the limits of location and time zones. We are in almost every country, acting as your global passport to the world’s currencies to explore the globe with ease.

24/7 Customer Support

You can reach us across multiple channels, in-app chat through your Leatherback account, our dedicated support email, and direct messages on social media.

Get started today, sign-up in minutes

Download the app to register

Verify your address to set up an account

Choose your country and verify your identity.

Request additional accounts and get them instantly - no waiting around!