Effective August 1, 2025

As businesses continue to expand globally and financial technology evolves, Leatherback is implementing updates to its Fusion for enterprise pricing structure, effective August 1, 2025.

These changes reflect strategic investments in infrastructure, compliance capabilities, and service delivery designed to better serve the growing needs of enterprise clients worldwide.

Why We're Updating Our Pricing

The global business landscape has transformed significantly over the past few years. Companies are expanding internationally at unprecedented rates, regulatory requirements are becoming increasingly complex, and demand for real-time financial solutions continues to surge.

To meet these evolving market demands, we will be making strategic investments across three key areas:

Infrastructure Expansion Leatherback is expanding Fusion’s underlying architecture to handle larger transaction volumes, improve system uptime, and deliver enhanced performance across all regions. This infrastructure upgrade will support faster transaction processing, reduced downtime, and more reliable service delivery.

Enhanced Risk and Compliance Standards As global regulations continue to evolve, we will be strengthening Fusion’s onboarding and service delivery processes for businesses operating in sensitive or high-risk sectors. These improvements ensure operations remain compliant and protected across multiple jurisdictions.

Advanced Customer Support Systems There will be an upgrade to customer support infrastructure to provide faster issue resolution, proactive monitoring capabilities, and access to specialised support teams. This enhancement will reduce response times and improve overall service quality.

Key Changes to Enterprise Pricing

The new pricing structure introduces several significant updates:

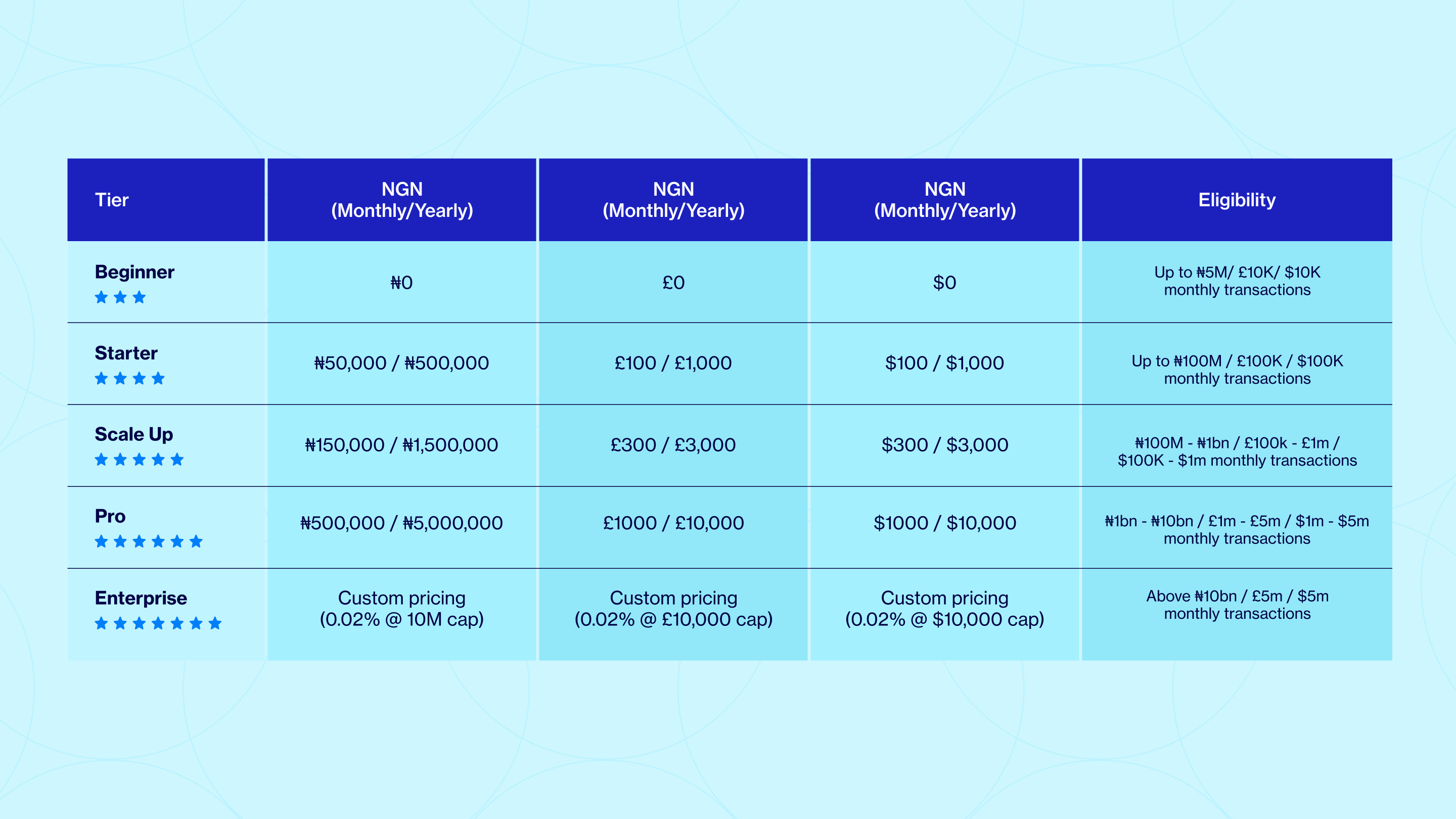

Tiered Pricing Model

We are launching a usage-based pricing structure that scales with business size and activity levels. This model ensures enterprises pay only for the services they use while providing better value as transaction volumes increase.

The tiered approach recognises that different businesses have varying needs. Startups processing hundreds of transactions monthly will have different pricing than enterprises processing thousands of transactions daily. The new structure creates natural price breaks that reward growth and increased usage.

Adjusted Onboarding Fees for High-Risk Clients

For businesses operating in higher-risk industries or jurisdictions, we'll be applying a revised onboarding fee to reflect the deeper compliance review required. This supports faster onboarding, clearer documentation pathways, and better long-term monitoring.

While this may represent an initial cost increase for some clients, it ultimately protects both their business and ours by ensuring all regulatory requirements are met from day one.

Benefits for Enterprise Clients

The new pricing model delivers several key advantages:

Scalable Flexibility Our pricing adjusts with your business. Companies are placed into tiers based on their monthly transaction volumes, ensuring they get the right features at the right time. This means you won’t overpay for unused features or stay stuck in a pricing structure that doesn’t support your growth.

Improved Service Quality Stronger infrastructure and upgraded support systems will deliver faster turnaround times, improved reliability, and reduced service disruptions. This translates to more predictable operations and fewer operational challenges.

Volume-Based Cost Efficiency The tiered model rewards growth by reducing per-transaction costs as volumes increase. This creates opportunities for enterprises to reinvest savings into business expansion and development.

Global Compliance Assurance Enhanced onboarding and compliance processes enable enterprises to operate confidently across multiple regions without regulatory friction. This reduces compliance overhead and accelerates international expansion efforts.

Change is never easy, but it's necessary for growth. These pricing updates represent our commitment to providing you with the most robust, compliant, and scalable financial infrastructure possible.

We believe that by investing in better systems, processes, and support today, we're setting the foundation for the next phase of growth for businesses.

For further questions regarding these changes, please contact our sales team