If you do business in West and Central Africa, you know the CFA franc is the backbone of commerce. It is used to pay suppliers, fund education, and manage cross-border trade around the region; having access to XAF (Central African CFA franc) and XOF (West African CFA franc) is essential.

Leatherback now gives business owners that access in a way that is simple, secure, and designed for growth.

What You Can Do with CFA Francs on Leatherback

Fund your wallet locally Use mobile money services like MTN MoMo and Orange Money to fund your Leatherback wallet in XAF or XOF from supported countries (such as Côte d’Ivoire, Senegal, Mali, Cameroon, Benin, and more).

Hold and manage CFA francs directly Your funds remain safe in your Leatherback multi-currency account, where they maintain their value in local terms.

Exchange with ease Convert your CFA francs into global currencies like USD, GBP, EUR, or NGN on the Leatheback app instantly, giving you the flexibility to operate both locally and internationally.

Prepare for payouts (coming soon) Soon, you’ll be able to not just fund and exchange, but also make direct payouts in CFA francs, making Leatherback a complete tool for managing money across borders.

Why XAF & XOF Matter for Your Business

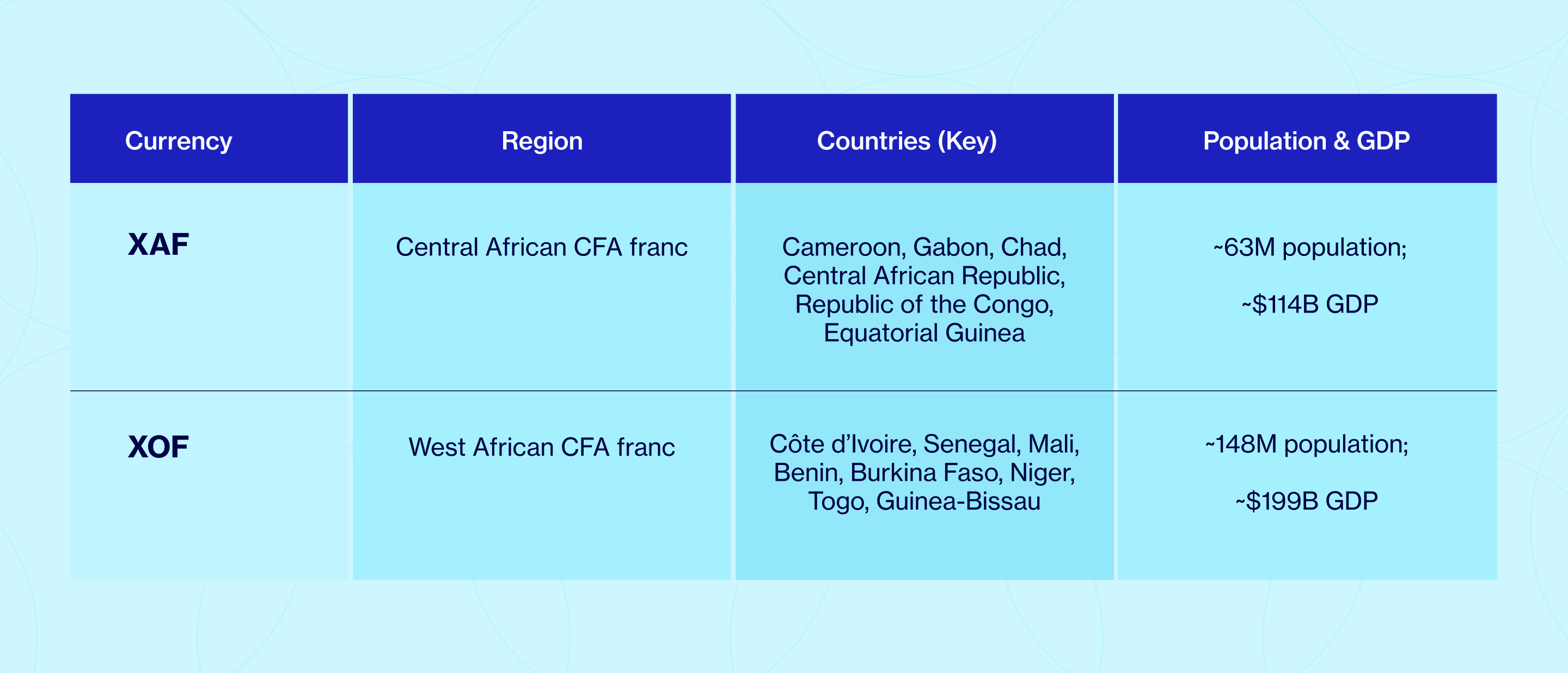

The CFA franc zones (CEMAC and UEMOA) cover over 200 million people across 14 countries, generating billions of dollars in trade every year. For businesses and individuals seeking to expand in these regions, access to currency is often the single biggest barrier.

By offering wallet funding, storage, and exchange in CFA francs, Leatherback removes that barrier. With access to these currencies, you gain:

Speed: Instant funding via mobile money.

Flexibility: Ability to exchange into multiple currencies.

Security: A trusted multi-currency wallet under your control.

Growth potential: Future payouts that will open new expansion opportunities.

CFA Franc Zones: At a Glance

By funding your wallet in XAF and XOF through trusted mobile money providers like Orange Money and MTN MoMo, your business secures direct access to the heart of Central and West Africa’s trade zones. This means you can store value locally, protect your operations from unnecessary conversion losses, and quickly exchange into global currencies whenever opportunities arise. Instead of relying on costly intermediaries or struggling with limited banking infrastructure, you maintain full control of your capital flows in one secure platform.