We all love it when our everyday activities become smooth and uninterrupted, from easy access to food, water, clothing, data, and money. And our emotions, without a doubt, get us unhappy when things don’t turn out how we expect, like dealing with delayed payments, transfer errors, and slow settlements when transacting across borders.

We also don’t like this, and this means you and us at Leatherback have the same interests in common. We already knew this and we are also aware that you love the good side of life, just as we do. To usher you into that good life you deserve, our solution helps you avoid everything that might make you feel unsatisfied regarding finances, international payments, and instant settlements.

With its uniqueness, the Leatherback app is home to a feature that enables swift and easy cross-border transactions for businesses and individuals. What’s this solution about? How does it work? How can I access this solution, considering we have common interests? Not to worry, keep reading to get answers to these questions and more.

SendR: A feature that makes payment easy

SendR is the Leatherback child product that enables individuals and businesses to send funds within and outside frontier markets. This feature is the most viable means of instantly completing cross-border transactions in multiple currencies. Cross-border payments are transactions where the payee and the transaction recipient are based in separate countries.

The transactions can be between individuals, companies, or banking institutions looking to transfer funds across territories and with frequent transactional needs within the company’s approved transaction limit.

SendR enables you to make international payments in multiple currencies within and outside the frontier market. With SendR, you can send funds in GBP or your local currency, and the beneficiary will instantly receive the funds in the currency of their choice, be it in USD, NGN, or CAD. Let’s dive into how SendR works, payment options, and how to get started.

How SendR works on the Leatherback app

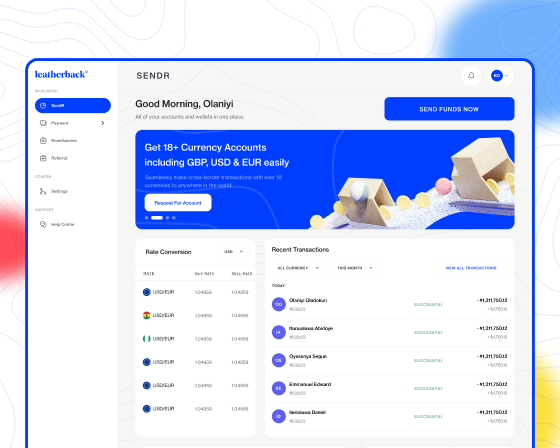

Using the SendR feature on your Leatherback account is seamless. First, you will be required to sign into your account, and once you are in, toggle your mouse or tap your screen to click on ‘SendR’ at the side navigation bar. The screen that shows up when clicked is your SendR dashboard. On this screen, you will see the currencies to transact with using SendR.

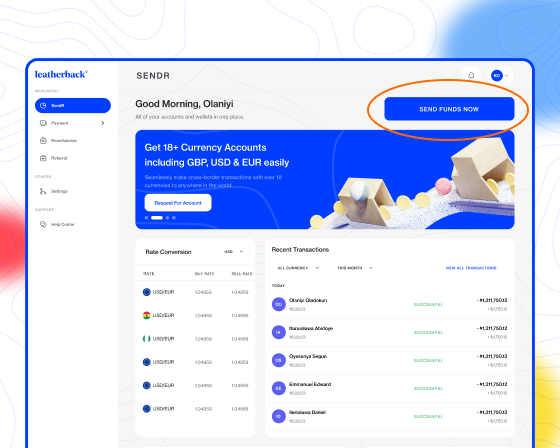

On this same screen, as shown in the image above, you can make instant transfers in the currencies of your choice. For instance, let’s assume you’d like to send money from your Euros account to a beneficiary’s GBP account. All you need to do is to click the ‘Send money’ button as shown below.

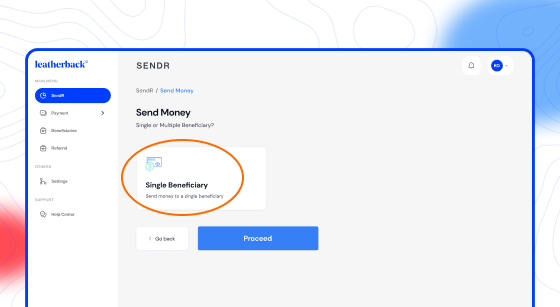

Click the single beneficiary button, and select your preferred payment method.

So, quick one! The payment methods on SendR are in two different forms;

Leatherback account

Bank transfer

Let’s discuss how you can make payments using any payment method.

Making SendR payments with your Leatherback account

Sending funds in a currency to another beneficiary’s currency account can be done using any of your Leatherback GBP, CAD, NGN, USD, and other currency accounts. To get this done, select the currency you want to use.

However, the availability of the currency you wish to send is determined based on the number of accounts attached to your Leatherback account. The steps below provide explanations of how you can use SendR with this payment method:

Click on the currency you want the beneficiary to receive, and the exchange rates will be seen.

Input the beneficiary’s bank details.

State a reason you are making the transaction and upload documents for proof. For instance, you can upload a payment invoice.

Review your payment and authorise the transaction by entering your transaction pin.

And that’s all! Now, let’s review how to use the second payment method, bank transfer.

Making SendR payments via bank transfer

This payment method allows you to transfer from your local or preferred bank account to our Leatherback account using our company account details. What happens if you move to our account? This is what happens:

‘When a transfer is made to our Leatherback account, once we receive the funds, we transfer it to the beneficiary on your behalf without any hassle.’

Seamless, right? Let’s discuss how you can get this done.

Choose the currency of the account you want to transfer to.

Add the beneficiary details.

State a reason you are making the transaction and upload documents for proof. For instance, you can upload a payment invoice.

Review your payment and authorise the transaction by entering your transaction pin.

Note: The Leatherback account detail is provided, and you must transfer to the account.

You’d agree that using any payment method we discussed is easy and swift. When you think of SendR, think of instant settlements. On our YouTube channel, we’ve made available some videos to guide you through how to make payments using the SendR feature.

Learn how to make a SendR transaction via bank transfer

Learn how to make a SendR transaction using Leatherback account payment option

If you are yet to own a Leatherback account to start making international business payments, check out the section below for steps on how to get started.

How to get started with Leatherback as a sole trader

Follow these steps to open a Leatherback account as a Sole trader:

Visit our website. Be informed that to open a Leatherback account, you must be a United Kingdom, Canada, or Nigeria resident.

Click on "Sign Up."

Click on the residence, the country you are signing up from, and click on what you are signing up as (Sole Trader).

Create your account with an email address and enter your password.

Click on 'Create Account.' A confirmation code will be sent to your email address. Enter the code and continue the process.

Click on the entity type you want onboarded as – Sole Trader.

Verify your identity by selecting a preferred Identity verification type from the available list and entering the Identification Number.

Enter your details; Name, residential address, phone number, state, and other vital information.

Once you are done registering, our team will review and approve your account within 48 working hours. If an error occurs while checking your account, our customer experience team will contact you and guide you on the next steps.

For more information about the documents needed to complete registration and upload formats, visit our support page. Stay in touch and keep abreast of financial tips and resources via LinkedIn, Instagram, Facebook, and Twitter.